inherited annuity taxation irs

3 hours agoOkay now some good news. In turn taxation of annuity distributions.

Annuity Taxation How Various Annuities Are Taxed

Tax Consequences of Inherited Annuities.

. These payments are not tax-free however. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is. Fixed period annuities - pay a fixed amount to an annuitant at regular intervals for a definite length of time.

The payments received from an annuity are treated as ordinary income which could be as high as a 37 marginal tax rate depending on your tax bracket. Either way you will pay regular taxes only on the interest. In many cases the IRS requires the first payment from an inherited IRA to be made by December 31 of the calendar year following the owners death.

The earnings are taxable over the life of the payments. However any interest thats been earned will be taxed once withdrawn. How the SECURE Act changed the rules for taxes on inherited IRAs.

If you inherit this type. If you inherited a non-spousal IRA in 2020 the IRS is not going to retroactively make you take an RMD for the 2021 tax year. To determine if the sale of inherited property is taxable you must first determine your basis in the property.

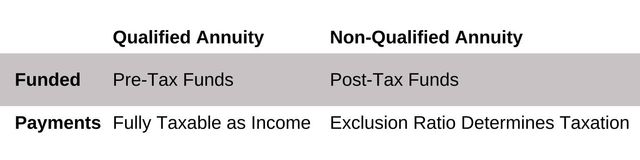

Variable annuities - make payments to an annuitant varying in amount. IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. Because retirees usually generate less income they enjoy reduced tax rates.

The SECURE Act which was signed into law in 2020 changed the rules for taxes on inherited IRAs for most. In this case taxes are owed on the entire difference between what the original owner. People inheriting an annuity owe income tax on the difference between the principal paid into the annuity and the value of the annuity at the annuitants death.

Any beneficiary including spouses can choose to take a one-time lump sum payout. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds. The government doesnt tax annuity funds until you start taking distributions in retirement.

IRS Publication 575 says that in general those inheriting annuities pay taxes the same way that the original annuity owner would. An individual who inherits a non-qualified annuity can take a lump-sum cash payment or a stream of payments. The reason is that these annuities have already been subject to income tax.

Nor will you be hit with. The basis of property inherited from a decedent is. How taxes are paid on an.

Inherited Annuity Tax Implications Once the money is inside of an annuity it grows tax-free or rather tax-deferred so the policyholder does not have to pay taxes on the growing account. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded with money that was already subject to taxes will still not be taxed.

Are Annuity Tax Benefits Taxable How Are Benefits Paid Out

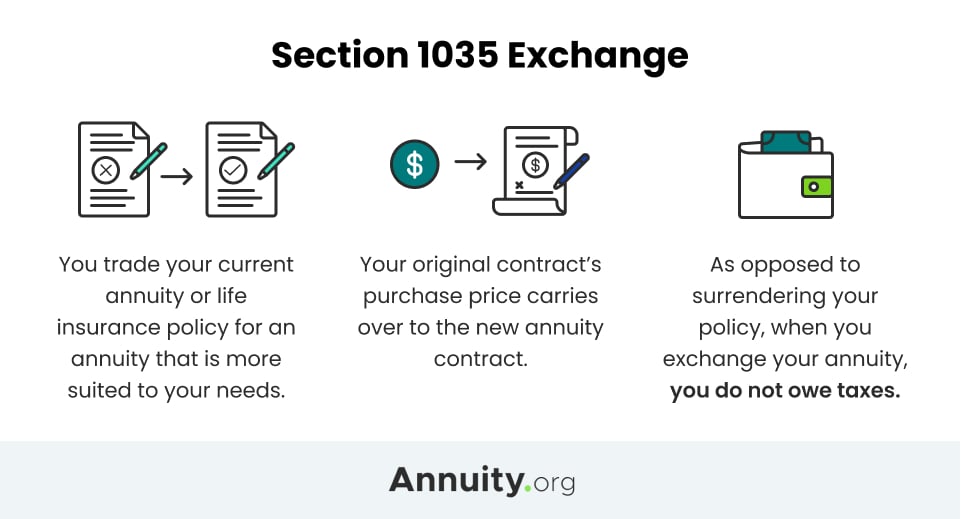

1035 Annuity Exchange Swapping One Annuity For Another

Many People Are Inheriting Annuities And Need To Know What Choices They Have Stan The Annuity Man

Inherited Annuity Tax Guide For Beneficiaries

Form 1099 R Instructions Information Community Tax

Publication 590 B 2021 Distributions From Individual Retirement Arrangements Iras Internal Revenue Service

How To Prove Funds Are Inheritance To The Irs

A Break For Inherited Annuities Retirement Watch

Seven Form 1099 R Mistakes To Avoid Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Tax Form 1099 R Jackson Hewitt

How To Figure Tax On Inherited Annuity

Inherited Annuities What Are My Options 2022

Inherited Annuity Tax Guide For Beneficiaries

Inherited Annuities What Are My Options 2022

Publication 575 2021 Pension And Annuity Income Internal Revenue Service